Medicare Supplement Open Enrollment: What You Need to Know

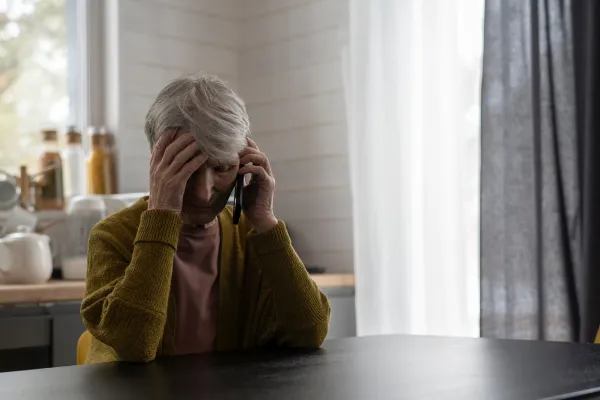

When you first become eligible for Medicare, the choices can feel overwhelming. One of the most important decisions you’ll make is whether to add a Medicare Supplement plan (also called Medigap) to help cover the costs Original Medicare doesn’t pay. But here’s the catch: the timing matters.

Why Timing Is Everything

Your Medicare Supplement Open Enrollment Period is a one-time window that begins the month your Medicare Part B becomes active and lasts for six months. During this time:

You can choose any Medicare Supplement plan available in your area.

You cannot be denied coverage for health reasons.

Insurance companies cannot charge you more because of your age or health conditions.

In short: this six-month period is your golden opportunity to get a Medicare Supplement plan without medical underwriting. Once it’s gone, it’s gone.

What Happens After Open Enrollment Ends?

If you try to apply for a Medicare Supplement after your open enrollment window closes:

You may have to answer health questions.

You could be charged more for coverage.

You may even be denied depending on your health history.

That’s why it’s so important to get clear on your needs early and make a decision during your first six months of Part B coverage.

Medicare Is the Boss

A common question we hear: “Will my Medicare Supplement cover a service if Medicare doesn’t?”

Here’s the truth: Medicare decides what is covered. If Medicare doesn’t cover it, your Supplement won’t either. The Supplement only pays the “gaps” in Medicare-approved services. To learn more about what Medicare covers check out our blog entry on What Does Medicare Cover.

How We Can Help

We know these choices can feel confusing, but you don’t have to make them alone. Our team at Mere Benefits has helped thousands of individuals navigate Medicare and make confident decisions. We’ll sit down with you, explain your options, and guide you through the enrollment process so you don’t miss this critical window.

Call us today at 904-654-5450 or visit www.merebenefits.com to schedule a no-cost consultation.